BFCM has come and again yet again! BFCM 2023 is officially over and we’re here with everything you need to know about what happened online.

First, the fast facts: Online sales reached $38B over Cyber Week 2023, up 7.8% from 2022, driven primarily by record spending on Thanksgiving and Black Friday, up around 5% and 7% YoY respectively.

Taken into context with the $109.3B already spent online through November 27—2023 is set to be a strong year for retailers despite economic concerns throughout the year.

Let’s see how Justuno customers fared over BFCM 2023 and which strategies had the best results this year.

Justuno customers had an average engaged order value of $241.50, up 6% from $227.98 in 2022. They converted visitors 132% more, with engaged conversion rates averaging 13.25% throughout the entire weekend compared to a 5.7% overall conversion rate.

*Cyber weekend is Thanksgiving, 11/23 to Giving Tuesday, 11/28

Pop-Up Performance: A Look At The Top-Converting Styles

We’re always being asked what the best practices are for pop-ups during Cyber Weekend: what style converts the most, sizing, placement, what’s most important to avoid – the list goes on. While every brand is different, there are a few general tips for success.

During Cyber Weekend:

- Don’t run lead captures and multi-step promotions

- Make it as simple as possible for your visitors

- Make it worth their while if you are going to interrupt them

Let’s check out where Justuno users found success with their onsite messaging during BFCM 2023.

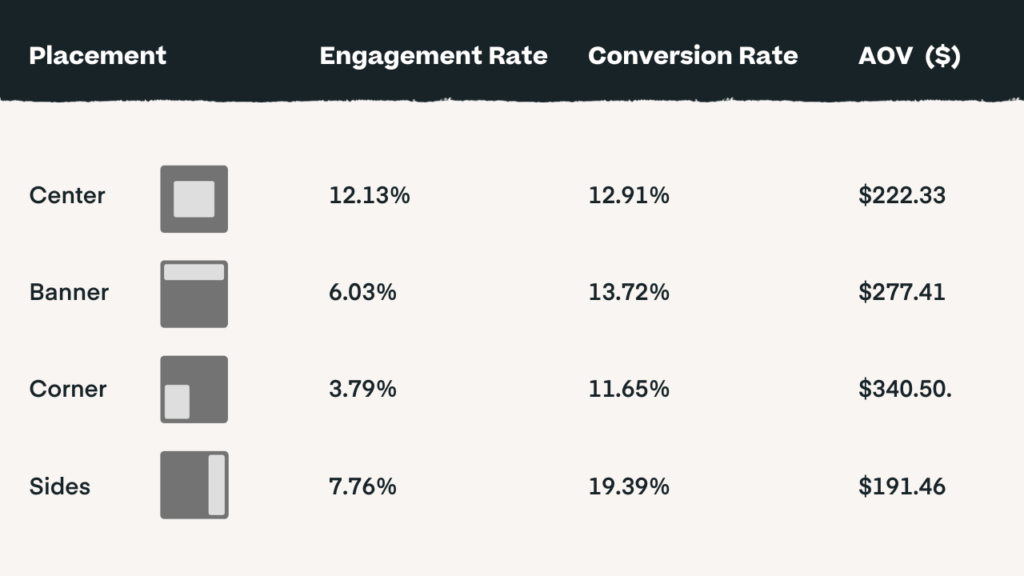

Location, Layers, and Plug-ins

When you think of pop-ups, you probably think of center promotions: the eye-catching displays that appear front and center, directly in front of visitors. As the most used placement by far, center pop-ups had the highest engagement rate at 12.13%. But when it came to conversion rates, they were in third place at 12.91% (though still an objectively great conversion rate). This is due to various factors, most importantly that the last promotion interacted with is attributed with the conversion. So promotions shown when someone first comes to your site will see lower conversion attributions if you’re also running those with in-cart promotions. Think of center promotions as the high-value conversion assistant to your onsite strategy.

Banners are a tried and true CRO staple during the holidays with their mobile-friendly design and non-interruptive nature. We encourage customers to use banners for important, site-wide messaging like shipping info, key deadlines, customer support, time-based sales, and more.

They were the second most popular location for pop-ups and boasted the highest second-highest AOV at $277.41 and the second-conversion rate (13.72%). They have the second-to-last engagement rate (6.03%), which is likely due to their information-focused use versus other popular promotions that drive users to checkout.

Corner and side pop-ups are a rising trend for creative pop-up designs and placements, with side promotions usurping corner promotions as the number one sales driver. For the last few years, these two have been fighting for the top spot with conversion (and AOV).

Corner promotions had the highest AOV at $340.5 and the side pop-ups were only at $191.46. Side pop-ups while having lower cart sizes converted at 19.39% vs. corner pop-ups at 11.65%. Making these winning promotions for marketers to use when looking to create subtle yet noticeable pop-ups or appeal to a more mobile-forward audience.

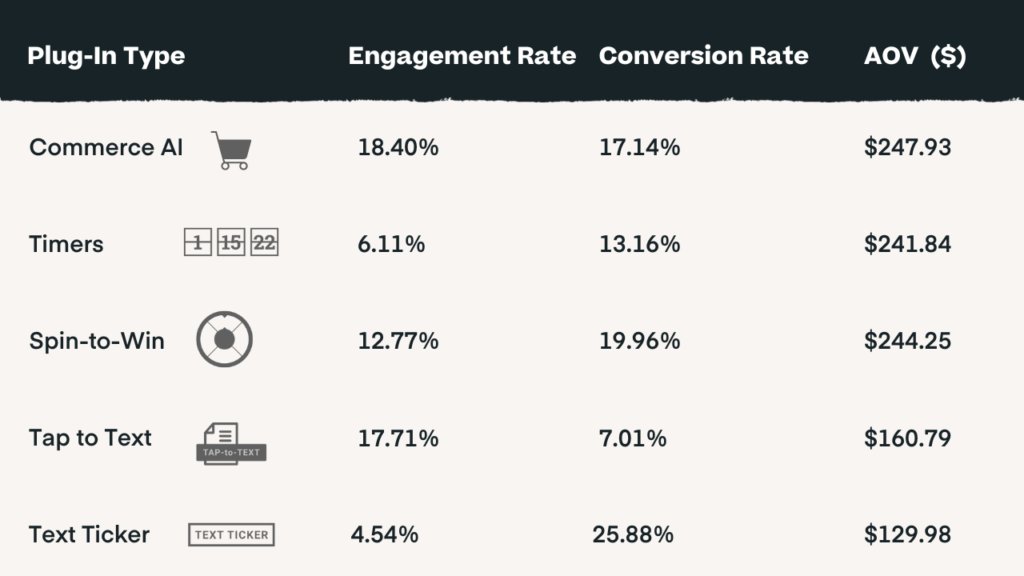

Now that we know where retailers were using pop-ups during BFCM let’s dive into the what and how of their onsite messaging campaigns. With Justuno, these two plug-in layers can be added to a promotion to drive sales even higher:

The takeaways from these stats are:

- Timers are an incredibly important addition to drive consumer urgency and boast a high conversion and AOV rate. Within the scope of BFCM being a limited-time event driven primarily by the fear of missing out on a great deal and limited available inventory – their impact is clear.

- Justuno’s intelligent product recommendation engine, Commerce AI, was the leader in engagement and boasted a 17% conversion rate. While BFCM is usually discount-focused, personalization was one of the largest draws for shoppers to engage with. Plus, personalized experiences contributed significantly to having the highest as well AOV by providing customers with more relevant products.

- Justuno’s text ticker feature is a fun and engaging way to show messaging on your banners. With the highest engaged conversion rate of the weekend at 25.88%, it’s clearly working to get shoppers’ attention!

It’s worth making an honorable mention for our tap-to-text feature—while we don’t advocate for lead captures during BFCM (more on that later), the tap-to-text SMS opt-in layer is an exception. It’s a low lift for your customers with just two taps to sign up—and we only had a few instances of it being used during Cyber Week. The few brands that opted to use BFCM as an opportunity to collect SMS leads in this manner saw great results in opt-in rates but the lowest overall engaged conversions. So we still recommend you turn all lead captures off during this time!

Coupons are one of BFCM’s defining features, yet this year’s engagement rates for promotions with vs. without coupons were relatively close at 11.5 and 8.9%. When it came to converting engaged traffic, coupons won out with 18.44% vs. 13.25%. This could be due to a variety of factors, such as merchants choosing to use manual coupons rather than auto-apply in their promotions or retailer concerns about profit margins with rising costs due to inflation.

Despite all of this though—brands who didn’t use coupons made 317% more revenue than those who did. Non-discount strategies have been becoming more popular throughout the rest of the year…makes us wonder if the days of deep discounts and blowout sales are over?

Mobile vs. Desktop

Shoppers lived up to their claim, saying they would be using mobile devices this holiday season (49.6% saying they would be shopping on mobile this year), with 71% of recorded sessions being from mobile visitors.

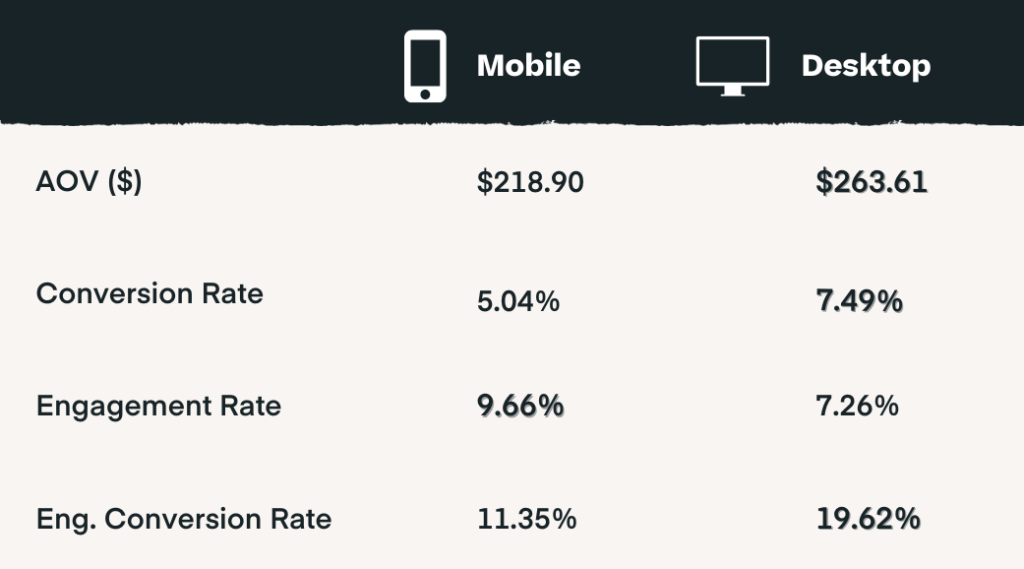

Conversion rates were higher for desktop users at 7.4% and 5.04% for mobile, but mobile visitors were more engaged with promotions at 9.6% vs. desktop’s at 7.26%. The impact of engagement to conversion rate skyrocketed desktop conversion rates to 19.62% vs. mobile’s 11.35%.

Most importantly, desktop’s average order value was also much higher at $263.61 than mobile’s at $218.90. – a nearly $45 AOV difference and worth keeping in mind for future holidays. Desktop promotions drove 10% more revenue than mobile promotions did.

Mobile visitors are plentiful and ready to engage/opt into promotions, but not necessarily at the point of conversion. It supports the theory that mobile is still primarily a discovery and research channel while desktop holds strong as the final point of sale.

This could be due to a variety of reasons like poor mobile experiences, difficulty checking out (unoptimized mobile carts), or slower website speeds. Take this as an area of opportunity for next year to stand out from the crowd and capture the attention of mobile shoppers to convert them earlier in the sales journey via an optimized mobile UX that streamlines any barriers to conversions you may have.

Industry Leaders

Breaking down BFCM by industries reveals a lot about consumer behavior and gifting trends in the long run. According to Justuno’s survey of 250+ US consumers*, they were planning to gift these categories:

- Clothing: 54%

- Electronics/Tech: 49.69%

- Games/Toys: 41%

- Home Goods: 32.8%

- Cosmetics: 19%

- Food & Beverage: 27.86%

- Jewelry: 29.85%

- Animal & Pet: 19.8%

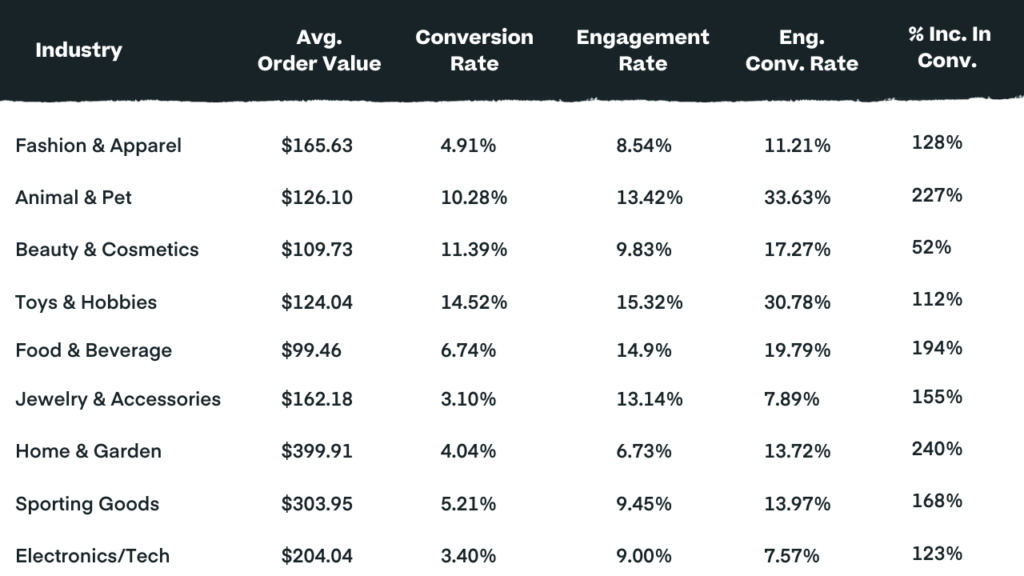

When compared to actual BFCM performance, these are the top contenders when broken down by website traffic, conversion rate, and engaged conversion rate.

The major industries that people were planning to shop all had solid traffic levels and overall engagement/conversion metrics. Some industries experienced a much higher impact from their promotions than others, with the top spots taken by home/garden and animal/pet care. Those had the largest increase in conversion with engagement.

*A survey conducted by Justuno this summer of 260 U.S. consumers

Final Thoughts On BFCM 2023

BFCM 2023 was an interesting one. There was particular emphasis on certain promotion styles than in previous years, alongside interesting twists when it came to onsite behavior (cough coupons cough). We’re seeing retailers break out of the mold for promotion placement and where consumers themselves are shifting focus (and dollars) during holiday shopping. Not to mention that many of our customers have been running their sales for a while & aren’t necessarily focusing on just BFCM weekend to get the job done during Q4.

That’s right in line with what consumers said during our survey this year, with nearly 45% planning to start shopping before BFCM started. Online spending for the entire season totals $109.3B already, and there are still several weeks left in the year to go!

Despite inflation and other economic factors, the Grinch hasn’t stolen Christmas quite yet, and e-commerce is not slowing down. Consumers are shopping when, where, and how they want—and retailers are helping them do just that!